It's not just the national taxes, state, county and city taxes in this country it's also the taxes that you don't see. A loaf of bread in this country is the highest taxed bread in the world because of all the hidden taxes. You guys have really know idea how heavily we're taxed, and that's the way the government likes it.

Questions about LA and history of the NFL

Collapse

X

-

Hey. I heard Wal-Mart makes money. Why don't we get rid of all that money-losing sand and sea water in San Diego and put up the biggest Super Wal-Mart ever made?Originally posted by KNSD View PostThey would need a dome to make it compatible with the convention center.

The reason the convention center doesn't want to share a facility with the Chargers is that they wouldn't be able to use the facility half of the year due to 1) the Chargers being there and 2) Uncertainty of NFL scheduling. You have to schedule the events a year or more in advance, so even away games are off limits for events.

Since the Convention Center is a money-maker entity for the city, it gets priority over a money-loser like a professional football team.

- Top

- Bottom

Comment

-

-

How many loaves of bread do you eat a month? Four, five maybe? What's that work out to? $20?Originally posted by Boltaction View PostIt's not just the national taxes, state, county and city taxes in this country it's also the taxes that you don't see. A loaf of bread in this country is the highest taxed bread in the world because of all the hidden taxes. You guys have really know idea how heavily we're taxed, and that's the way the government likes it.

In England, the price of gas is about $10 per gallon. Do that math.

- Top

- Bottom

Comment

-

-

I think the link I provided included pretty much everything. Waiting on your link.Originally posted by Boltaction View PostIt's not just the national taxes, state, county and city taxes in this country it's also the taxes that you don't see. A loaf of bread in this country is the highest taxed bread in the world because of all the hidden taxes. You guys have really know idea how heavily we're taxed, and that's the way the government likes it.Prediction:

Correct: Chargers CI fails miserably.

Fail: Team stays in San Diego until their lease runs out in 2020. (without getting new deal done by then) .

Sig Bet WIN: The Chargers will file for relocation on January 15.

- Top

- Bottom

Comment

-

-

In Timor Leste, people pay twice as much money in taxes as they make?Originally posted by KNSD View PostPlease provide proof (hopefully to a link that doesn't involve calling the US a dictatorship).

Here's mine: http://en.wikipedia.org/wiki/Government_spendingLast edited by Guest; 05-25-2015, 10:52 AM.

- Top

- Bottom

Comment

-

-

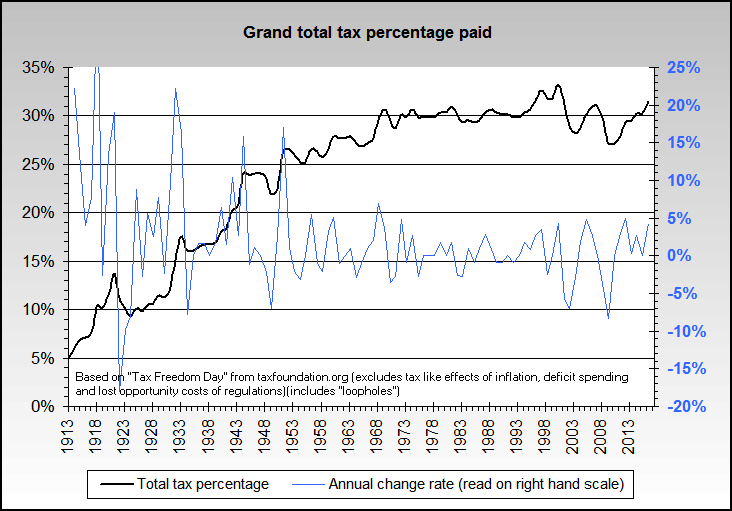

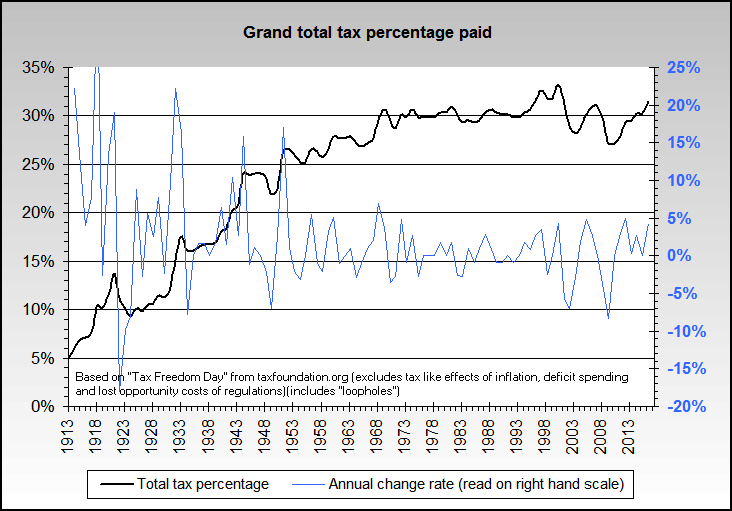

The average tax we pay direct is 58% placed on the average citizen of the USA, and that doesn't include all the hidden taxes buried in products we buy. BTW, almost all the taxes below were placed on our generation of citizens and some on our parents, but almost all these taxes were non existent in the USA just under 100 years ago. It's not taxes that made our country great it's the hardworking citizens this country is over taxing. Making us from the free est citizens in the world 100 years ago into the non free est slaves of governments in the world. And yet many always want to increase taxes, I see nothing but ignorance in increasing taxes. Just Don't do it. Freedom!!!!!!!!!! We need Freedom!!!!!!

How much tax do we really pay?

U.S. Stock Market, interest rates, property Prices, Fannie Mae, Gold, Gold Coins, Oil, Bubble Economy, world currency, forecast, prediction, traders, greenspan, Wall Street, Investments, currency, global cycles

U.S. Stock Market, interest rates, property Prices, Fannie Mae, Gold, Gold Coins, Oil, Bubble Economy, world currency, forecast, prediction, traders, greenspan, Wall Street, Investments, currency, global cycles

A partial list of the various ways in which citizens of the US are taxed: It's just about impossible to list them all.Item Rate Notes

Federal personal income tax 17%

(2011 est. - 18.2%) Top 39.6% rate. Source

State & local income taxes 10.1%

(2010 - 9.9%) State taxes range from under 6% to over 12%. Local taxes run from zero to 2.75%. Source, source, source, 2009 source

Sales tax 9.7%

(2009 - 10.3%) Figure is the average rate. State sales taxes range up to 8% and local taxes run from zero to over 5%. In 2010, state and local collections averaged $925 per capita.Source, source, 2008 source (broken link as of 2012), 2009 source 2011 source

Social security & Medicare 7.65% Total rate is actually 15.3% since half is paid by the employer, but we're ignoring that to be kind and to avoid being accused of being too political.

Federal and state corporate income tax share 2.5% Based on corporate taxes being approximately 1/6 of personal taxes, and that they are paid by individuals in the final analysis.

Property tax 2.5%

(2011 - 2.8%) Yearly average actual costs range from under $200 in Alaska to almost $1900 in New Jersey. State and local property taxes in fiscal 2010 averaged $1424 per capita, with a low of $539 in Alabama to $2819 in New Jersey) per the Tax Foundation. Source

Fuel/gasoline tax .5%

(2009 est. - .6%) Approximately 23% of the 2005 gasoline price is for federal & state taxes. The federal excise tax is 18.4 cents per gallon. Per the CPI, about 6% of the average budget is for transportation. Estimated. 2010 estimate, $.45 per gallon average. As of January 1, 2013, the lowest rate was 8 cents per gallon in Alaska and the highest was 50.6 cents in New York per the Tax Foundation.Source

Other 6%+

(2009-2013 - 8%+) Includes estate tax, fees, licenses, real inflation losses, inheritance, deficit allowance, gift, and others noted below. Estimated.

Here is what happened on January 1st 2014:

Top Income Tax bracket went from 35% to 39.6%

Top Income Payroll Tax went from 37.4% to 52.2%

Capital Gains Tax went from 15% to 28%

Dividend Tax went from 15% to 39.6%

Total tax percentage potentially paid by the well above average US citizen, 2005 - 53.2% *

Total tax percentage potentially paid by the well above average US citizen, 2013 est. - 58.5% *

Accounts Receivable Tax

Building Permit Tax

Capital Gains Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Court Fines (indirect taxes)

Deficit spending and debt servicing (Fiscal 2011 state and local debt per capita was $9184)

Dog License Tax

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel permit tax

Gasoline Tax

Hunting License Tax

Inflation

Inheritance Tax Interest expense (tax on the money)

Inventory tax IRS Interest Charges (tax on top of tax)

IRS Penalties (tax on top of tax)

Liquor Tax (Spirits, wine and beer)(From zero per gallon in Vermont to $34.22 in Washington for spirits)

Local Income Tax

Lottery (Fiscal 2011 per capita average was $59)

Luxury Taxes

Marriage License Tax

Medicare and Medicaid Taxes

Property Tax

Real Estate Tax

Septic Permit Tax

Service Charge Taxes

Social Security Tax

Road Usage Taxes (Truckers)

Sales Taxes

Recreational Vehicle Tax

Road Toll Booth Taxes

School Tax

State Income Tax

State Unemployment Tax (SUTA)

Telephone federal excise tax

Telephone federal universal service fee tax

Telephone federal, state and local surcharge taxes

Telephone minimum usage surcharge tax

Telephone recurring and non-recurring charges tax

Telephone state and local tax (Cell phone state and local tax rates in 2013 range from 1.85% in Oregon to 18.67% in Nebraska)

Telephone usage charge tax

Toll Bridge, Tunnel and Road Taxes

Traffic Fines (indirect taxation)

Trailer Registration Tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit TaxLast edited by Boltaction; 05-25-2015, 11:26 AM.

- Top

- Bottom

Comment

-

-

U.S. Stock Market, interest rates, property Prices, Fannie Mae, Gold, Gold Coins, Oil, Bubble Economy, world currency, forecast, prediction, traders, greenspan, Wall Street, Investments, currency, global cycles

U.S. Stock Market, interest rates, property Prices, Fannie Mae, Gold, Gold Coins, Oil, Bubble Economy, world currency, forecast, prediction, traders, greenspan, Wall Street, Investments, currency, global cycles

* The total average tax paid is closer to 43%

The average tax rate of 43% is confirmed for both the wikipedia document and this document. Your document proves the US tax system is very regressive since higher earners pay much less as a percentage of income.

If average citizens in other countries pay less in taxes than US citizens, it must be because they have a much more progessive tax system than us. (Don't know if this is true or not).Prediction:

Correct: Chargers CI fails miserably.

Fail: Team stays in San Diego until their lease runs out in 2020. (without getting new deal done by then) .

Sig Bet WIN: The Chargers will file for relocation on January 15.

- Top

- Bottom

Comment

-

-

It's almost impossible to really calculate the hidden costs of taxes in our products we consume in the USA, and the government wants to keep it that way. Believe we are the most taxed nation in the world.

In honor of tax day, here’s Ronald Reagan’s great quote on how there are 151 taxes in a mere loaf of bread. It’s from 1975, and I can’t say for sure if the same is true today. But if anything, my guess would be that that number has gone up, rather than down. The quote […]

In honor of tax day, here’s Ronald Reagan’s great quote on how there are 151 taxes in a mere loaf of bread. It’s from 1975, and I can’t say for sure if the same is true today. But if anything, my guess would be that that number has gone up, rather than down. The quote […]

Here is the article from Ronald Reagan about the hidden costs of taxes on just bread. Every product in America includes these hidden costs, some more than others but they all include them.151 Taxes in a Loaf of Bread

April 15, 2009 by mattperman

In honor of tax day, here’s Ronald Reagan’s great quote on how there are 151 taxes in a mere loaf of bread. It’s from 1975, and I can’t say for sure if the same is true today. But if anything, my guess would be that that number has gone up, rather than down.

The quote is from a very enjoyable and helpful interview in general with Reagan that I just came across (from 1975). I would recommend reading the whole thing.

Here’s the quote I’m referring to:

If people need any more concrete explanation of this, start with the staff of life, a loaf of bread. The simplest thing; the poorest man must have it. Well, there are 151 taxes now in the price of a loaf of bread — it accounts for more than half the cost of a loaf of bread. It begins with the first tax, on the farmer that raised the wheat. Any simpleton can understand that if that farmer cannot get enough money for his wheat, to pay the property tax on his farm, he can’t be a farmer. He loses his farm. And so it is with the fellow who pays a driver’s license and a gasoline tax to drive the truckload of wheat to the mill, the miller who has to pay everything from social security tax, business license, everything else. He has to make his living over and above those costs. So they all wind up in that loaf of bread. Now an egg isn’t far behind and nobody had to make that. There’s a hundred taxes in an egg by the time it gets to market and you know the chicken didn’t put them there!

Last edited by Boltaction; 05-25-2015, 11:44 AM.

- Top

- Bottom

Comment

-

-

1. Did you see the budget deficits while Reagan was in office? Reagan spent his way out of recession.

2. Farmers aren't going out of business. Somehow they are able to afford these "hidden costs."

3. Government-owned roads (among other things such as the military since today is Memorial Day) didn't get there on their own. Somebody has to pay for them.Prediction:

Correct: Chargers CI fails miserably.

Fail: Team stays in San Diego until their lease runs out in 2020. (without getting new deal done by then) .

Sig Bet WIN: The Chargers will file for relocation on January 15.

- Top

- Bottom

Comment

-

-

Unfortunately the infrastructure is being maintained much the same way the Q is..... Deferred maintenance.Originally posted by KNSD View Post1. Did you see the budget deficits while Reagan was in office? Reagan spent his way out of recession.

2. Farmers aren't going out of business. Somehow they are able to afford these "hidden costs."

3. Government-owned roads (among other things such as the military since today is Memorial Day) didn't get there on their own. Somebody has to pay for them.

- Top

- Bottom

Comment

-

Comment